28

DEC 2017

FOOD FOCUSTHAILAND

SPECIAL

FOCUS

VietnamFoodRetailBusiness

Growingdramatically

In the current situation, Vietnam’s food

retail industry is growing unstoppably,

especially the market value which grows

averagely 16.9% annually throughout our

period of research (2011 – 2015). Only in

2015, the industry earned 1,371.4 trillion

dong profit from sales in 648,900 branches

(Figure1),mostlybecauseof theexpansion

of convenience store, whosemarket value

growth increased3 foldsduring theperiod.

The trend was the result of changing

lifestyle, for which many Vietnamese are

working longer house, particularly office

workers, and they do not have enough

time to shop for grocery. Therefore, these

consumers are hoarding large amount

of food, instant food specifically, to safe

cooking time. Such kind of products are

often available in modern retail store,

hypermarket, and supermarket, which

are different types of retail store that are

flourishing rapidlyduring this sameperiod.

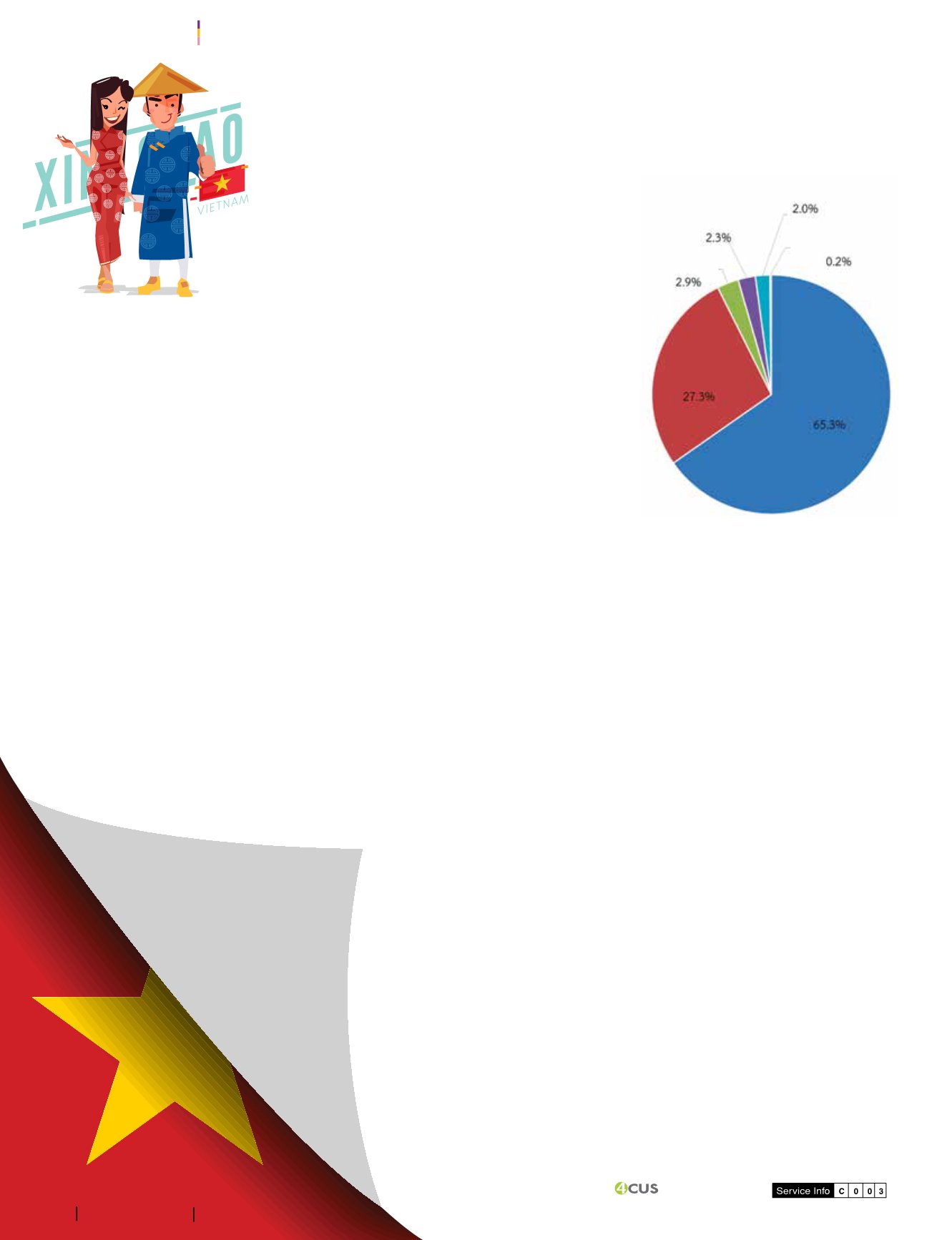

Figure2:

Retail BusinessesMarket Share

Per BusinessType inVietnam in2015

Source:

Euromonitor International

Food/Drink/

CigaretteShop

Hypermarket

ConvenienceStore

Traditional

ConvenienceStore

Independent

Traditional

ConvenienceStore

Supermarket

Internet food retail store is another

interestingshoppingchannel forVietnamese

consumers. Many giant retail stores; for

example, Saigon Union of Trading

Cooperatives and Casino Guichard-

Perrachon, are developing their websites in

respond to the new consuming behaviour

where many prefer to purchase items from

theirhomes.Nonetheless,manyVietnamese

housewives still prefer to come to the retail

stores. Housewives in urban area are often

foundshoppingatmodern retail stores,while

those in rural areas are keen to shop from

wetmarketsorsmall conveniencestores.For

the provincials, it is easier for them to travel

to convenience stores close to home than

stopat supermarketsandwait for thequeue,

because they usually commute on

motorcycles.

In2015, traditional retail store is themain

channel for food trade inVietnam, taking95%

of the totalmarket value, and99.8% in terms

ofnumberofbranches.Traditional retail store

includes wet market and small independent

convenience store, who controls 65.3% and 27.3% of the national market share per

volume, respectively. (Figure2)Nevertheless, traditional retail storesare indeclineafter

manyVietnameseconsumerschanged frombuying food fromwetmarket tobuying from

supermarket.Supermarketsalso runpromotioncampaign, e.g. pricecut, toattractmore

consumers. Meanwhile, discounters are not yet seen in Vietnam as many large retail

chainshold close relationshipswith foodmanufacturers, hence, there isnoneed to rely

on suppliers for discounts.

TheKeyPlayers

Saigon Union of Trading and Cooperatives, has long been the leading food retailer in

Vietnam, controlling 1.9% of the retail market value. In 2015, its “Co.opMart” and “Co.

op Food” has 117 branches and 80 branches nationwide, respectively. “Co.opMart”

recently develop a mobile phone application for loyal customers to collect points and

receive news and promotions. Not only that, there’s also hypermarket players like “Big

C” (by CasinoGuichard-Perrachon) and “LotteMart” (by Lotte Shopping), who control

1.5% and 0.3% of themarket share, respectively. We also see a new player in 2015,

“Vinmart” (byVinPro), who kickedoff withmore than100branches and stole somemarket

share from “Fivimart” (byTCTGroup). Eventually,AeonVietnamhasbrought 30% share

from “Fivimart”,and49% from “Citimart” (byDongHungTradingService) tomaintain these

businesses. “Co.opMart”and “BigC” focusonpricecutstrategy,while “LotteMart” targets

medium to high income consumers. “Fivimart” and “Citimart”, on the other hand, add

import foods to their strength, especiallywith Japanese products.

Market Trends

Food retail industry inVietnam isset for continuousgrowth. In2020, it is forecasted that

the industrywillgenerate1,679.5 trilliondongsandexpandaveragelyat4.1%perannum

between 2016 – 2020. The expected growth rate is relatively decelerated compared to

the researchperiod,partlybecause theslowdownofVietnamesepopulationgrowthafter

cost-of-livinghas risenandmoreVietnamesewomenareentering the jobmarket.More

andmoreworkingpopulationdecide to remainsingle toease theburden fromchildcare.

Nevertheless, it ispredicted thatconveniencestorewillhave themostacceleratedgrowth

withaverage17.8%expansion invalue,due to thatmany retailersareplanning toestablish

more branches, particularly in rural area. On the other hand, traditional retail store is

seen to be in decline and losing competitiveness to modern retail store as the latter

provides food products in a better quality and safety.

Furthermore,wewill seeaclearer expansion fromonlineandmobileapplication, as

a resultofcomplicated lifestyleofVietnamese.Many retailersarekeen todevelopwebsites

andapplications topromotenewsandpromotionoffers,whichwillbemorebudget friendly

compared to television advertisement.